You are here

Back to topBank Indonesia has issued a new overarching regulation that seeks to implement a major overhaul of the payment licensing framework in Indonesia, in line with the digital economy framework outlined in the 2025 Indonesia Payment System Blueprint.

The new regulation, BI Regulation No. 22/23/PBI/2020 on Payment System (Indonesian language), will adopt an activity and risk-based approach instead of the previous institutional-based approach to classify and regulate companies in the payment sector – in other words, adhering more to the principle of “same risk, same regulation”.

This general overhaul is thought necessary because digitalisation and innovation in the payment sector have brought about increasing complexity and variations in business models for payment services operators, to such an extent that the corresponding increase in risk may have a systemic impact on the stability of the financial system as a whole.

Under the new regulation, Bank Indonesia classifies payment companies into two broad categories, according to their activities:

- payment services providers (penyedia jasa pembayaran or PJP), covering: (i) provision of information on source of funds, (ii) initiation of payments and/or acquiring services, (iii) management of source of funds, and (iv) remittance services. Payment companies currently licensed to provide e-money, e-wallet, payment gateway, funds transfer and merchant acquiring services should fall under this category.

There are three sub-categories of PJP: Category 1 PJP companies, which are permitted to undertake all four activities; Category 2 PJP companies, which are permitted only to undertake the activities set out in points (i) and (ii) above; and Category 3 PJP companies, which may undertake only the activity set out in point (iv) above, and other activities approved by Bank Indonesia. This “bundling” of multiple services under one licence (in contrast to the current multiple licences required for each sub-category of payment services) is likely to lead to the simplification of an increasingly complex payment licensing regime.

- payment system infrastructure operators (penyelenggara infrastruktur sistem pembayaran or PIP), covering clearing and settlement services.

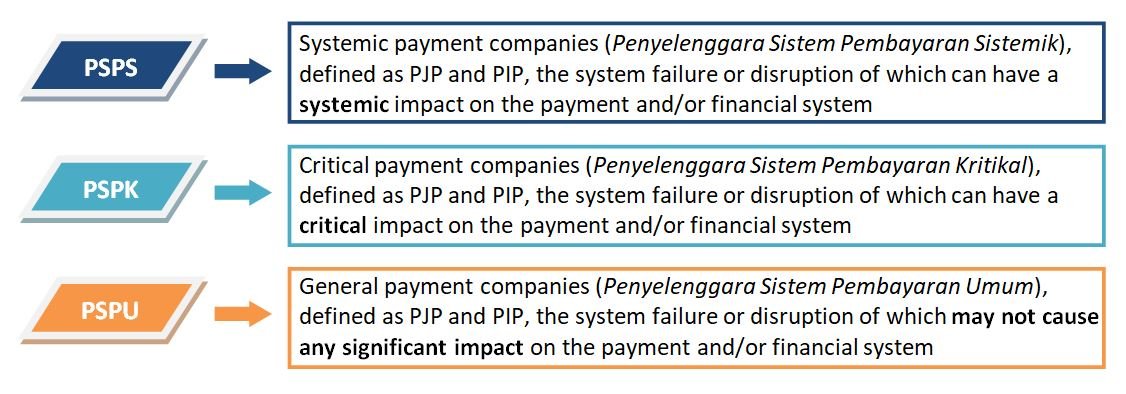

To address the increasing systemic risk that payment companies may pose to the payment and/or financial system as a whole, PJPs and PIPs will also be classified into three categories based on the potential risk that their system failure or disruption could cause to the payment system and/or financial system, i.e. (i) systemic payment companies, (ii) critical payment companies, and (iii) general payment companies.

A number of factors will be taken into account by Bank Indonesia in making the classification, including the payment companies’ market share, the value of the transactions they process, and the inter-connectivity of their systems with the infrastructure of other players. This classification is intended to provide a better understanding of the structure of the payment industry, and of the respective payment companies’ role and/or contribution to the overall payment system ecosystem.

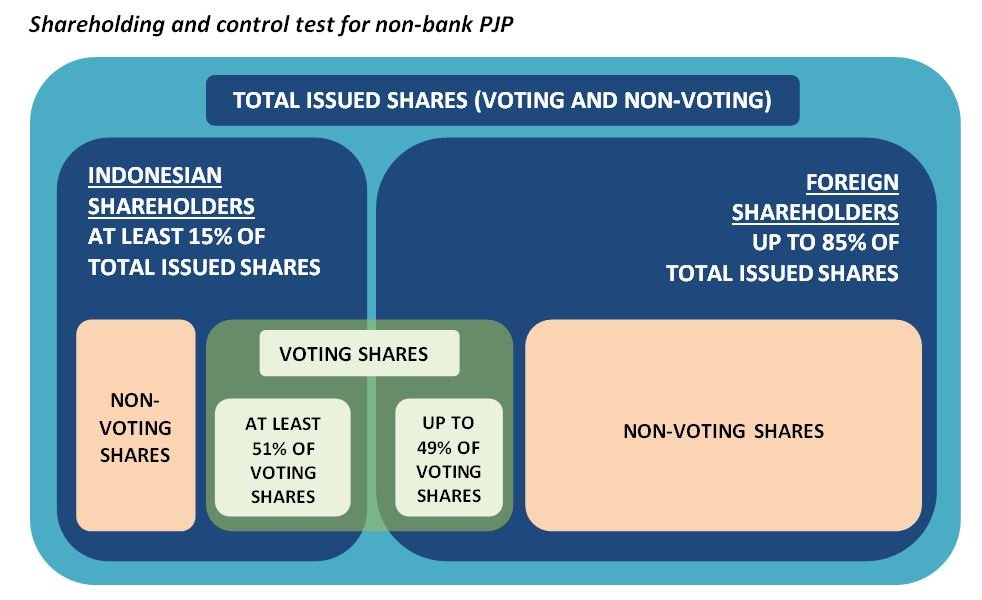

Another notable change introduced by this regulation relates to minimum local shareholding requirements (which by implication set the ceiling for foreign shareholding). The regulation sets out two tests that have to be satisfied:

- total shareholding test – at least 15% (direct and indirect up to the ultimate shareholder) of the total shares in a non-bank PJP must be owned by Indonesian shareholders, and at least 80% (direct and indirect up to the ultimate shareholder) of the total shares in a non-bank PIP must be owned by Indonesian shareholders; and

- domestic control test – at least 51% (direct and indirect up to the ultimate shareholder) of the shares with voting rights in a non-bank PJP must be owned by Indonesian shareholders, and at least 80% (direct and indirect up to the ultimate shareholder) of the shares with voting rights in a non-bank PIP must be owned by Indonesian shareholders. The regulation also provides that if there is any special right:

(i) to nominate a majority of the board of directors and/or board of commissioners; or

(ii) in the form of a veto right over any decision or approval by the general meeting of shareholders which has a significant impact on the company (e.g., amendment of articles of association, change of capital structure, appointment of directors or commissioners, merger, consolidation, acquisition, spin-off or dissolution),

then such right must be held by the Indonesian shareholders.

This regulation will come into effect on 1 July 2021. Companies currently applying to Bank Indonesia for a payment license will have to ensure they comply with this regulation. For existing licensed payment companies, Bank Indonesia will conduct an assessment of such companies (including in relation to the re-classification of services or products provided) and, based on that assessment, Bank Indonesia will convert their licenses following 1 July 2021.

These licensed payment companies will have to indicate whether they will be able to comply with the relevant capital, risk management, and information system capability requirements within two years (from 1 July 2021). If they indicate that they are not able to comply, Bank Indonesia will require them to satisfy all their rights and obligations (in connection with their operations as a payment company) within two years, and Bank Indonesia will revoke their licenses once such rights and obligations have been satisfied.

The two-year time frame discussed here does not appear to apply to the new minimum local shareholding requirements. Rather, the grandfathering provisions of the regulation suggest that Bank Indonesia will only require existing licensed payment companies to comply with the new minimum local shareholding requirements in the event of any change of composition of foreign shareholding or change of control by a foreign party, as the case may be, unless such change of shareholding composition or change of control event is carried out pursuant to the discretionary policy or supervisory action of Bank Indonesia.